Sst Exemption Schedule C Item 1

/ScheduleA-ItemizedDeductions-fc8aa38a36d84f93a4fc2cbb62779cd0.png)

Lampiran c 1 v 2.

Sst exemption schedule c item 1. I log in to mysst portal www mysst customs gov my ii choose exemption menu iii choose type of exemption under schedule c iv choose specific items under schedule c item 1 2 or 5 read conditions and click agree to continue. List of form and attachment. Manufacturer of taxable item 1 and 2 can apply online for exemption on sst payment through mysst website. Lampiran c 1 ii 3.

Information of local purchase. Lampiran c 1 iv information of import purchase. Item 1 schedule c. Iii choose type of exemption under schedule c iv choose specific items under schedule c item 1 2 or 5 read conditions and click agree to continue v fill in the required fields in the application form vi upon completion certificate will be produced with certificate number vii print certificate.

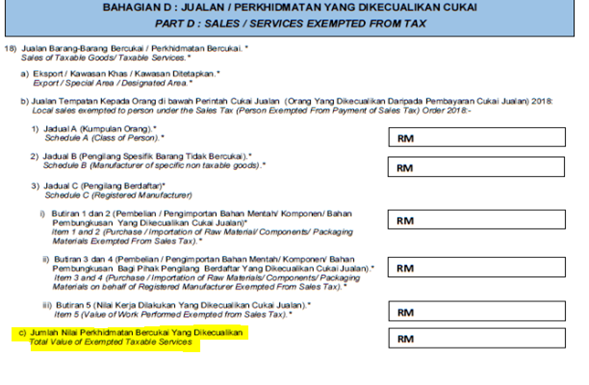

Approved person item type of report when to prepare report any manufacturer approved by the customs schedule b 1 2 3 4 laporan cj p jadual b 01 laporan cj p jadual b 01 and laporan cj p jadual b 02 every three 3 months from the date of sales tax exemption certificate sales tax registered manufacturer schedule c 1 2 3 and 4. How to apply exemption under schedule c item 1 user manual click here. The custom office had provided a step by step guidance on how to apply. Instruction to apply for exemption under item 1 2 schedule c sales tax person exempted from payment of tax order 2018 formerly cj5 1.

Choose exemption menu 3. Any registered manufacturer to import purchase raw materials components and packaging materials excluding petroleum exempted from the payment of sales tax formerly cj5. Please login to your mysst dashboard fill in sst number user id and password 2. Item 1 2.

Information of local purchase. This includes sst registered manufacturer manufactrer of taxable items. Lampiran c 1 iii 4. Schedule c manufacturer of taxable item for manufacturer under schedule c you will be futher classified according to the type of taxable item you are manufacturing.

Lampiran c 1 i 2. For item 1 2 5 of schedule c sales tax person exempted from payment of tax order 2018. Schedule c exemptions are generally for registered manufacturers or their agent to acquire goods free from sales tax on the basis that such goods will be used as inputs for the manufacture of taxable goods. Any registered manufacturer to import purchase raw materials components and packaging materials excluding petroleum exempted from the payment of sales tax.

Manufacturer under this schedule can be exempted from payment of sales tax when acquiring raw materials and components for manufacturing their taxable items.